Bank Reconciliation Statement- Complete Guide for Class 11 Accountancy Chapter 5

Our learning resources for the chapter, Bank Reconciliation Statement – Chapter 5 – Accountancy for Class 11th are designed to ensure that you grasp this concept with clarity and perfection. Whether you’re studying for an upcoming exam or strengthening your concepts, our engaging animated videos, practice questions and notes offer you the best of integrated learning with interesting explanations and examples.

When managing a current account, it’s essential to ensure that the bank’s records match the account holder’s. Raj Pal & Sons is currently operating an account with Punjab National Bank. Ideally, if the bank says they have a deposit of Rs 2,50,000 on a particular date, Raj Pal and Sons should also reflect this amount in their records. But, as is often the case, discrepancies arise. Factors that cause these differences are studied under the Bank Reconciliation Statement. Can you guess the factors that cause differences in the two statements?

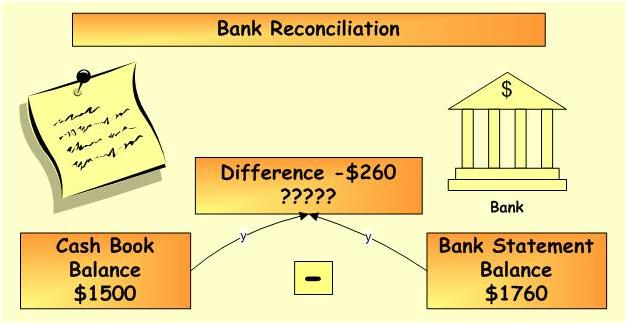

Bank Reconciliation Statement

Let’s explore what a Bank Reconciliation Statement is and why it’s crucial for financial accuracy.

A Bank Reconciliation Statement is prepared to reconcile the balance of the Cash Book with the Bank Statement.

So, that’s the gist of a Bank Reconciliation Statement. Now, let’s move on to understanding some related terms that will help you get a clearer picture.

Related Terms

Before diving deeper, it’s important to get familiar with some key terms that play a significant role in bank reconciliation.

- Cash Book: An accounting book that keeps the record of receipts and payments made through bank and cash.

- Pass Book: A book that consists of the statement of account of a customer maintained by the bank.

Now that we’ve understood the related terms, let’s examine the nature of the Cash Book and Bank Statement.

Nature of the Cash Book and Bank Statement

To get a better grasp, let’s compare the Cash Book and the Bank Statement.

Cash Book (bank column only) Bank Statement Debit represents increase Dr (represents decrease) Credit represents decrease Cr (represents increase) Balance (represents the amount owed to the clients)

With the nature of these books clear, we can now look at the causes of differences between the Cash Book balance and the Pass Book balance.

Causes of Differences Between Cash Book Balance and Pass Book Balance

When it comes to balancing books, timing and errors are two major causes of differences. Let’s delve into these causes.

Difference Because of the Timing

There is a time gap between the entry of a particular transaction in the cash book and the passbook. As a result, there is a difference between their balances.

Difference Because of Errors

Understanding the timing and errors is crucial. Next, let’s look at the specific causes of these differences.

Specific Causes of Differences

There are several specific reasons why discrepancies occur. Let’s explore them.

- Cheques issued but not presented for payment

- Cheques deposited but not yet collected

- Direct payment made by the bank on behalf of the customer

- Amount directly deposited in the bank account

- Interest and dividends collected by the bank

- Cheques deposited/bills discounted dishonored

Now, let’s break down each of these causes in more detail.

Detailed Causes of Differences

Cheques Issued But Not Presented for Payment

When a cheque is issued to a party, it is immediately recorded in the bank column of the passbook. It reduces the bank balance as shown in the cash book. However, the bank will debit the customer’s account only when the cheque is presented for payment.

Cheques Deposited But Not Yet Collected

When a firm receives cheques from its customers, these are immediately recorded on the debit side of the cash book. This increases the bank balance as per the cash book. However, the bank credits the customer’s account only after the clearance of the cheque.

Direct Payment Made by the Bank on Behalf of the Customer

The bank debits the customer’s account as soon as it makes the payment. The customer credits the bank account only when he comes to know about such payments.

Direct Collections on Behalf of the Customers

The bank credits the customer’s account as soon as it receives the payment. The customer debits the bank account only when he comes to know about such collections.

Cheques Deposited Dishonoured

It is first recorded on the debit side of the passbook. The account holder will make the entry only when he sees the passbook.

Having understood the causes of differences, let’s explore how errors can affect the reconciliation process.

Difference Due to Errors

Errors in the Cash Book or Pass Book can lead to differences in balances. Let’s understand these errors.

Error in the Cash Book

- Cheques/cash deposited into the bank but not recorded in the cash book.

- Cheques issued but not recorded in the cash book or recorded in the cash column.

Error in the Pass Book

- The cheque was collected by the bank but not recorded in the passbook due to wrong posting in another customer’s account.

- Deposit recorded on the withdrawal side and vice-versa.

Now that we’ve covered errors, let’s see how to balance the Cash Book and Pass Book effectively.

Balance as per Cash Book

To reconcile the balances, we need to understand the adjustments required. Here’s how to do it:

Let’s now have a look at the formats of rectification in Passbook and Cashbook.

Passbook Rectification Format:

| Particulars | Plus Items | Minus Items |

| Bank balance as per cash book | ||

| Add transactions that increase the balance in the passbook: | ||

| (+) Cheques issued but not yet presented | XX | |

| (+) Direct collection on behalf of the customer is not recorded in the cash book | XX | |

| (+) Directly deposited by a customer | XX | |

| Less transactions that decrease the balance in the passbook: | ||

| – Cheques deposited but not yet collected by the bank | XX | |

| – Direct payments made by the bank on behalf of the customer | XX | |

| – Cheques deposited dishonored | XX | |

| Balance as per passbook | XXX |

Cash book Rectification Format:

| Particulars | Plus Items | Minus Items |

| Bank balance as per passbook | XX | |

| Add transactions that increase the balance in the cash book: | ||

| (+) Cheques deposited but not yet collected by the bank | XX | |

| (+) Direct payments made by the bank on behalf of the customer | XX | |

| (+) Cheques depositeddishonored | XX | |

| Less transactions that decrease the balance in the cash book: | ||

| – Cheques issued but not yet presented for payment | XX | |

| – Direct collection on behalf of the customer not recorded in the cash book | XX | |

| Balance as per cash book | XX | |

Having the format in place, let’s see an example for a better understanding.

Example of Balance as per Cash Book

Let’s consider an example to illustrate the balance reconciliation process.

Bank’s Books Depositor’s Records Beginning balance Rs 10,000 Beginning balance Rs 15,000 Add: Deposit not recorded by the bank Rs 8,000 Cheques deposited but not yet credited Rs 8,000 Add: Interest credited by the bank Rs 1,000 Credit made by the bank for interest Rs 1,000 Less: Cheque issued but not presented Rs 5,000 A cheque was issued but not presented for payment Rs 5,000 Total Rs 14,000 Total Rs 19,000

Now, let’s prepare a Bank Reconciliation Statement with some specific details.

Solved Questions

Question 1. Prepare the Bank Reconciliation Statement from the following details:

- Balance as shown by cash book: Rs 20,000

- Balance as shown by bank passbook: Rs 22,000

- Cheques issued but not yet presented for payment: Rs 8,000

- Cheques deposited but not yet collected: Rs 6,000

Answer.

Bank Reconciliation Statement Particulars Amount (Rs.) Balance as per cash book 20,000 Add: Cheques issued but not presented 8,000 Total 28,000 Less: Cheques deposited but not credited by the bank -6,000 Balance as per the passbook 22,000

Question 2. Prepare the Bank Reconciliation Statement from the following details starting with the Passbook balance:

- Balance as shown by cash book: Rs 20,000

- Balance as shown by bank passbook: Rs 22,000

- Cheques issued but not yet presented for payment: Rs 8,000

- Cheques deposited but not yet collected: Rs 6,000

Answer.

Bank Reconciliation Statement Particulars Amount (Rs.) Balance as per passbook 22,000 Add: Cheques deposited but not credited by the bank 6,000 Total 28,000 Less: Cheques issued but not presented -8,000 Balance as per the cashbook 20,000

Finally, here’s a standard format to help you prepare a Bank Reconciliation Statement efficiently.

Format of BRS

| Particulars | Amount Rs. (+) | Amount Rs. (-) |

| Balance as per cash book | XX | |

| Add: Cheques issued but not presented | XX | |

| Add: Interest credited by the bank | XX | |

| Less: Cheques deposited but not credited by the bank | XX | |

| Less: Bank charges not recorded in the cash book | XX | |

| Balance as per the passbook | XXX |

Note: Entries will be reversed if the BRS starts with a passbook balance.

In conclusion, mastering the Bank Reconciliation Statement is vital for anyone studying Class 11 Accountancy Chapter 5. The Bank Reconciliation Statement serves as a crucial tool to ensure that the records maintained in the Cash Book are in sync with those provided by the bank’s Pass Book. By understanding the differences caused by timing, errors, and specific causes such as unpresented cheques and direct deposits, you can effectively manage and reconcile any discrepancies that may arise.

Our resources for Class 11 Accountancy Chapter 5—Bank Reconciliation Statement are designed to make this process straightforward and engaging. With our animated videos, practice questions, and detailed notes, you’ll gain a clear and comprehensive understanding of how to prepare and interpret Bank Reconciliation Statements. Remember, this chapter not only helps in preparing for exams but also enhances your practical accounting skills. Keep exploring these resources to refine your understanding of Bank Reconciliation Statements and excel in your Accountancy studies.

Practice questions on Chapter 5 - Bank reconciliation Statement

Get your free Chapter 5 - Bank reconciliation Statement practice quiz of 20+ questions & detailed solutions

Practice Now

Wow what a writer and what a crazy website developer!

Great sir

thanks matcha