Depreciation Provisions and Reserves- Complete Guide For Class 11 Accountancy Chapter 7

Our learning resources for the chapter, Depreciation Provisions and Reserves – Chapter 7 – Accountancy for Class 11th are designed to ensure that you grasp this concept with clarity and perfection. Whether you’re studying for an upcoming exam or strengthening your concepts, our engaging animated videos, practice questions and notes offer you the best of integrated learning with interesting explanations and examples.

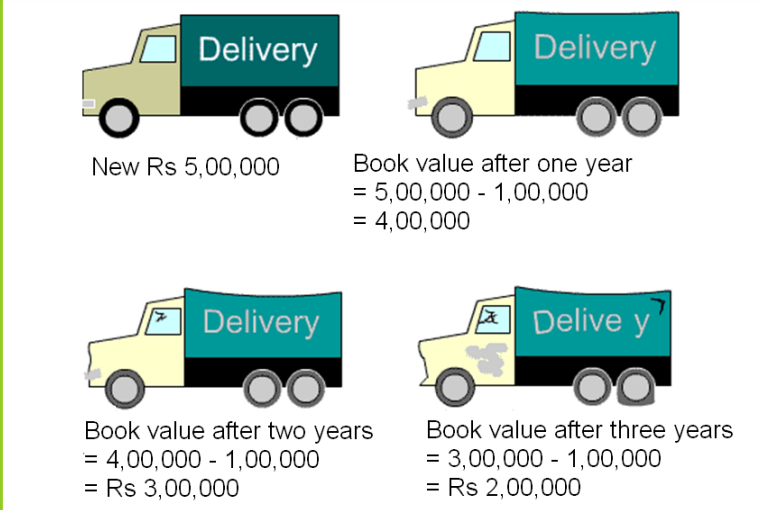

When businesses invest in assets, it’s essential to understand how these assets’ values change over time. Let’s dive into an example to illustrate this concept.

- Rs 1,00,000 is a capital expenditure, expected to benefit for 10 years, not just one year.

- It is logical to charge a part of the total cost, say Rs 10,000 (one-tenth of Rs 1,00,000), against the revenue for the year 2005.

- Rs 10,000 represents the expired cost or reduction in the value of the machine and is referred to as ‘Depreciation’.

- The useful life of machinery is estimated to be 10 years.

- A machine is purchased for Rs 1,00,000 on April 01, 2005.

For example, if a machine costing Rs 1,00,000 is expected to wear out after ten years, we reduce the balance sheet value by Rs 10,000 annually. This process is known as ‘depreciation’.

So, we now understand that the accounts of a business recognize that the cost of a fixed asset is consumed as the asset wears out, by writing off the asset’s cost in the profit and loss account over several accounting periods. Let’s move on to understanding depreciation in detail.

Let’s start with simple definitions

Defining Depreciation Provisions and Reserves

Depreciation:

In Class 11 Accountancy Chapter 7 – Depreciation Provisions and Reserves, depreciation is defined as the reduction in the value of an asset over time due to wear and tear. It is recorded as an expense to reflect the asset’s decreased value.

Provisions:

Provisions are amounts set aside from profits to cover anticipated future expenses or liabilities. They ensure that financial statements reflect potential obligations realistically.

Reserves:

Reserves are funds set aside from profits for specific purposes, such as future investments or unexpected expenses. They help in stabilizing financial health and supporting long-term goals

Depreciation

Depreciation is a critical concept in accounting. It accounts for the reduction in the value of an asset over time. Let’s explore this further.

- Depreciation means a fall in the value of an asset.

- Every fixed asset is liable to lose its value once it begins to be used.

Depreciation Characteristics

Understanding the characteristics of depreciation helps in appreciating its impact on financial statements. Here are the key points:

- Depreciation reduces the book value of an asset.

- It is a non-cash expense.

- Depreciation is charged on fixed assets.

- It is a continuous process.

These characteristics are driven by several causes, which we will now discuss.

Causes of Depreciation

Several factors contribute to the depreciation of assets. The main causes include:

- Wear and Tear

- Efflux of Time

- Obsolescence

- Accidents

Now that we have a good grasp of the causes, let’s explore the accounting concept of depreciation.

Accounting Concept of Depreciation

The accounting concept of depreciation is about distributing the cost of fixed assets over their estimated useful life in a reasonable manner. For example, if an asset is purchased for Rs 1,00,000 and its useful life is ten years, then depreciation @ Rs 10,000 per year should be charged.

To calculate depreciation accurately, we must consider several factors.

Concept of Depreciation

When calculating depreciation, several bases need to be considered:

- Historical cost of an asset

- Scrap value: The value of the asset at the end of its useful life.

- Useful life: How long will the asset last?

- Methods:

- Straight Line Method

- Diminishing Balance Method

Each of these methods has its objectives and factors affecting the amount of depreciation charged. Let’s delve into these next.

Objectives of Charging Depreciation

Charging depreciation serves several purposes, including:

- Ascertaining the profit or loss properly.

- Showing a true and fair view of the financial position.

- Showing the assets at their proper value.

- Retaining funds out of profits for replacement.

The amount of depreciation is affected by various factors, which we’ll cover next.

Factors Affecting Amount of Depreciation

The key factors that influence the amount of depreciation include:

- Original cost of the asset

- Scrap or residual value

- Estimated effective life

The cost of the asset encompasses several elements.

Cost of Asset

The total cost of an asset includes:

- A photocopy machine is purchased for Rs 5,00,000 from Japan. Its transportation cost amounted to Rs 6,000, transit insurance amounted to Rs 5,000 and the purchaser paid Rs 200 for registration papers. The original cost of the machine is Rs 5,11,200 (5,00,000 + 6,000 + 5,000 + 200) which will be written off as depreciation over the useful life of the machine.

- Transportation and registration cost

- Other costs like transit insurance, commission paid on purchase, etc.

- Invoice or purchase price

- Installation cost

Once the asset cost is determined, the next step is to record depreciation in the books.

Method of Recording Depreciation

Recording depreciation involves the following journal entries:

- Depreciation A/c Dr. To Asset A/c (With the amount of depreciation) XXX

- Profit and Loss A/c Dr. XXX To Depreciation A/c XXX (For the closing of depreciation account)

Depreciation will be transferred to the profit and loss account.

Next, let’s discuss the different methods for providing depreciation.

Methods for Providing Depreciation

Two primary methods are used for providing depreciation:

- Straight Line Method: The same amount of depreciation is charged every year.

- Diminishing Balance Method: The amount of depreciation is reduced every year.

We’ll start with the Straight Line Method.

Straight Line Method

The straight-line method involves charging the same amount of depreciation throughout the life of a fixed asset. Here’s the formula:

Depreciation is calculated using the formula:

Depreciation= (Cost – Estimated Scrap Value) / Expected Life Of the Asset

In simple terms:

- Subtract the estimated scrap value of the asset from its original cost.

- Divide the result by the expected life of the asset.

This will give you the annual depreciation expense.

Let’s go through the steps in calculating depreciation using this method.

Steps in Calculation

- Compute total cost of asset = purchase price + other cost

- Compute the amount of depreciation per year

- For the first year of depreciation, adjust the months for which it is used in the business

Example

- The cost of a Tractor = Rs 30,000

- Scrap value = Rs 5,000

- Useful Life = 5 years

Solution

- Depreciation = (Cost – Scrap Value) / Useful Life

- Depreciation = (30,000 – 5,000) / 5 = Rs 5,000 per year

This method maintains a consistent depreciation amount each year. Now, let’s look at the diminishing balance method.

Written Down Value Method

In the Written Down Value Method, depreciation is charged at a fixed rate on the reduced balance every year. This method is also called the reducing balance method or diminishing balance method. For instance:

- The cost of machinery is Rs 1,00,000 and the rate of depreciation on the diminishing balance method is 10%.

- In the first year, the amount of depreciation will be 10% of Rs 1,00,000 i.e., Rs 10,000.

- In the second year, the amount of depreciation will be 10% of Rs 90,000 (1,00,000 – 10,000) i.e., Rs 9,000 and so on.

Example

Cost of a Computer = Rs 28,000 Installation charges = Rs 2,000 Rate of Depreciation = 10% p.a.

Calculate depreciation for three years on computer under the diminishing value method.

Solution

- 1st year on Rs 30,000 @ 10% = Rs 3,000

- 2nd year on Rs 27,000 i.e., 30,000 – 3,000 = 27,000 x 10/100 = Rs 2,700

- 3rd year on Rs 24,300 i.e., 27,000 – 2,700 = 24,300 x 10/100 = Rs 2,430

This method gradually reduces the depreciation amount each year. Next, let’s see how to handle the sale of an asset.

Sale of Asset

When an asset is sold, depreciation is charged for the period it has been used. Book value is calculated on the date of sale, and the profit or loss on the sale of the asset is also computed. Here’s how:

- In case of profit: The sale price of asset > Book value on the date of sale

- In case of loss: The sale price of asset < Book value on the date of sale

Journal Entries

- On sale of assets: Cash/Bank Account Dr. To Assets Account

- Profit on sale of asset: Asset Account Dr. To Profit and Loss Account

- In case of loss on sale of asset entry (2) will be reversed. For-profit, profit, and loss accounts are credited. Cash is received and asset is going out from the business.

Example

The book value of the asset as of 1 January 2006 is Rs 50,000. Depreciation is charged on the asset @ 10%. On 1 July 2006, the asset is sold for Rs 32,000. The profit or loss on the sale will be calculated as follows:

Solution

- Book value as of 1 Jan, 2006 = Rs 50,000

- Less: Depreciation for 6 months @ 10% (from 1 Jan 2006 to 30 June 2006) = Rs 2,500

- Written down value as on 1 July 2006 = Rs 47,500

- Less: Sale proceeds as of 1 July, 2006 = Rs 32,000

- Loss on the sale of asset = Rs 15,500

The following entry will be passed on 1st July, 2006:

- Bank Account ………….…Dr. Rs 32,000

- Profit and Loss Account …Dr. Rs 15,500 To Asset Account Rs 47,500

So far, we have understood the impact of depreciation on asset valuation. Now, let’s compare the two methods of calculating depreciation.

Comparison Between Straight Line Method and Diminishing Balance Method

Fixed Installment Method Diminishing Balance Method Depreciation is calculated on the original cost of a fixed asset. Depreciation is calculated on the diminishing balance. Depreciation remains the same for all years. Depreciation decreases year after year.

After understanding how depreciation is handled, let’s discuss the concept of reserves.

Reserves

Reserves are amounts set aside out of profits to strengthen the financial position of the business. Reserves play a vital role in managing future contingencies and ensuring stability.

Importance of Reserves:

- Improving financial position

- Meeting unforeseen contingencies

- Making dividends uniform from year to year

- Meeting legal requirements

Different types of reserves serve different purposes. Let’s explore them.

Types of Reserves

Reserves can be broadly categorized into:

- Revenue Reserves: Created out of business profits.

- Capital Reserves: Created from capital profits.

- General Reserves: Not earmarked for any specific purpose.

- Specific Reserves: Created for specific purposes.

Understanding reserves is crucial for financial stability. Now, let’s delve into provisions.

Provisions

Provisions are funds set aside from profits to cover future liabilities and expenses. Provisions ensure that the business can meet its obligations.

Examples of Provisions:

- Provision for depreciation

- Provision for bad/doubtful debts

- Provision for taxation

A key provision that businesses often create is for bad and doubtful debts. Let’s see how this is handled.

Provision for Bad and Doubtful Debts

A provision for bad and doubtful debts is created to cover the risk of non-repayment by debtors. This helps in maintaining accurate financial records.

Journal Entry:

When provision for bad debts is created:

plaintext

Copy code

Profit and Loss Account Dr.

To Provision for Bad and Doubtful Debts Account

Next, we’ll cover provisions for discounts on debtors.

Provision for Discount on Debtors

This provision is made to cover discounts given to debtors who make prompt payments. It helps in managing the overall profitability accurately.

Journal Entry:

When provision for discount on debtors is created:

Profit and Loss Account Dr.

To Provision for Discount on Debtors Account

Now, let’s wrap up our understanding by comparing reserves and provisions.

Difference Between Reserves and Provisions

Basis Reserves Provisions Appropriation An appropriation of profit Charge on Profit Financial Position Created to strengthen the financial position Made to meet known liability or contingency

Key Terms on Your Fingertips

Let’s review some key terms to solidify our understanding:

- Depletion: Reduction in the availability of natural resources like mines and quarries.

- Amortization: Writing off the cost of intangible assets like patents and trademarks.

- Salvage Value: Also known as scrap value; the net realizable value of an asset at the end of its useful life.

- Depreciable Cost: Cost of an asset less its net residual value.

In conclusion, Class 11 Accountancy Chapter 7 – Depreciation Provisions and Reserves provides a comprehensive understanding of how businesses manage and account for asset depreciation, provisions, and reserves. This chapter delves into the essential concepts of depreciation, including its calculation methods and impact on financial statements. By mastering Depreciation Provisions and Reserves, students gain valuable insights into the management of asset value reductions and financial planning.

Understanding the different methods for calculating depreciation, such as the Straight Line Method and the Diminishing Balance Method, is crucial for accurate financial reporting. Additionally, differentiating between reserves and provisions helps in comprehending how businesses set aside funds for future needs and unforeseen expenses.

Our learning resources for Depreciation Provisions and Reserves – Chapter 7 – Accountancy for Class 11th are designed to make these concepts accessible and engaging. With animated videos, practice questions, and detailed notes, we aim to provide a clear and thorough understanding of these key accounting principles. Embrace the depth of Class 11 Accountancy Chapter 7 – Depreciation Provisions and Reserves to excel in your studies and apply these principles effectively in real-world scenarios.

Practice questions on Chapter 7 - Depreciation Provisions and Reserves

Get your free Chapter 7 - Depreciation Provisions and Reserves practice quiz of 20+ questions & detailed solutions

Practice Now

very well explained